WHO

WE ARE

EAT is an agribusiness financing, commercial and financial flow management platform. We provide integrated solutions for institutional investors, borrowers and other players involved in the agribusiness supply chain..

Our proposition is to reduce credit or market risk inherent in the agribusiness cycle for all players by better collateral and hands-on management of loans, commercial contracts and risk management.

EAT’s philosophy is to align interests between players and act as a risk-reducing agent for the various participants in the production chain.

Solutions

- LONG TERM FINANCING

- SHORT TERM FINANCING

- COMMERCIAL MANAGEMENT AND LOGISTICS

- RISK MANAGEMENT

LONG TERM

FINANCING

Our operation is based on long-term institutional capital, contributed by international investors and complemented by the local capital market. We have structured operations with a term of up to 8 years, amortized upon delivery of products and with a payment schedule adjusted forcrop seasonality.

SHORT TERM

FINANCING

EAT has partnerships with dozens of input and material companies (pesticides, fertilizers, seeds, machines, irrigation, warehouses, etc.). The borrower negotiates directly with the input provider a cash discount and EAT disburses directly against the supplier in question. Payment also occurs via export of products.

COMMERCIAL MANAGEMENT

AND LOGISTICS

Our financing operations are amortized upon delivery of products. EAT is a trading company that unites the line borrower and the final off-taker, without, however, adding risk or taking proprietary positions. We manage the purchase and sale contracts, reducing systemic risk in the financing chain.

RISK MANAGEMENT

Following up field operations to final consumption, we combine years of experience in agriculture with leading-edge risk management concepts to provide customized financial and market risk management solutions.

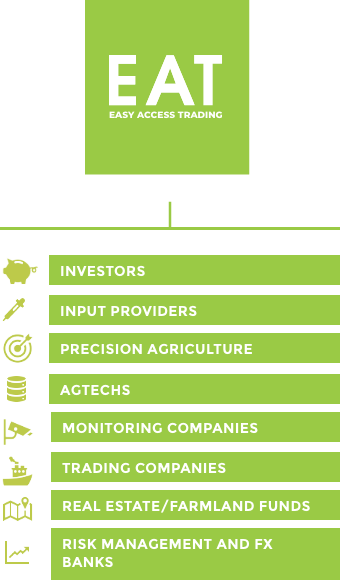

PARTNERS

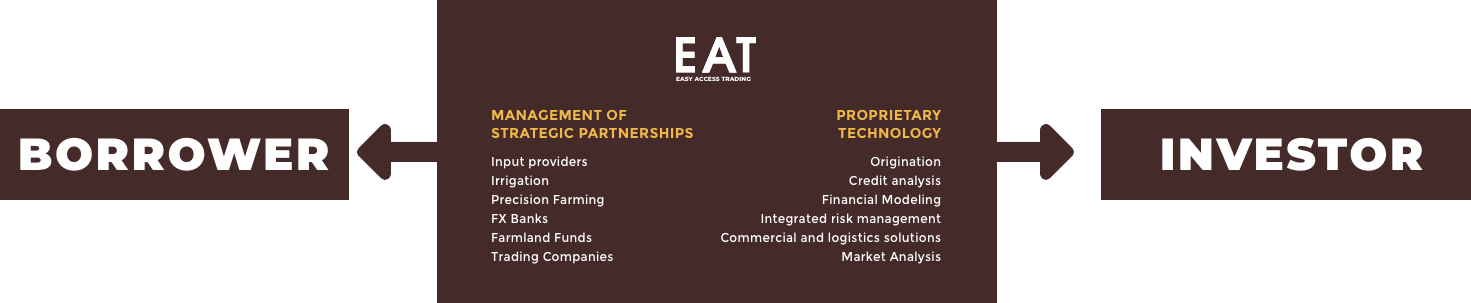

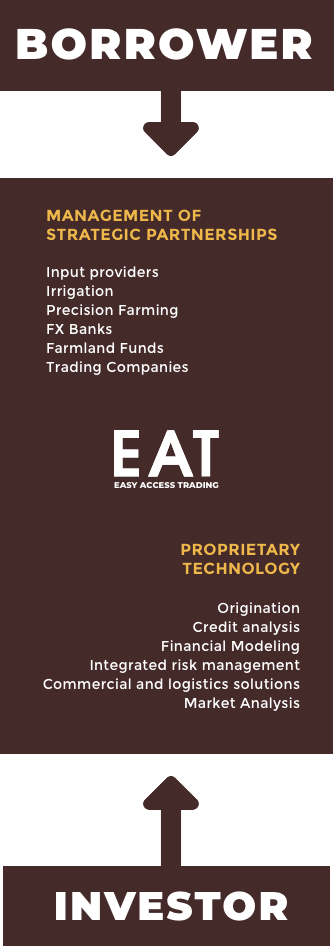

EAT acts as a counterparty in the commercial and financial flows associated with the financing transaction . The objective is to mitigate the risks associated with each flow to ensure the sustainability of eachtransaction and maximize the return for investors who seek exposure agribusiness. EAT’s approach has synergies with all key links in the chain: trading companies, chemicals and input resellers, irrigation companies, precision agriculture, brokers, foreign exchange banks, land funds, monitoring companies and other partners.

INVESTORS

The EAT platform allows agribusiness participants to make commercial decisions with total transparency and a privileged view of countless components and stages of the production chain. Through strategic partnerships, this business model adds different solutions to borrowers of structured finance lines while mitigating risks taken by investors. With a platform approach, EAT synchronizes origination, credit analysis, commercial management, risk management, payment alternatives and execution of guarantees.

RISK MANAGEMENT

Risk management is one of the prerequisites for long-term success in agribusiness. EAT develops proprietary models for risk management and quantification, market intelligence and accumulates years of experience in hedging, market analysis and management of derivative portfolios.

We assist our partners in making purchase and sale decisions using strictly technical parameters and in line with the best market practices.

Despite being an integral part of the management of financing operations, EAT also provides risk management services as an independent product and service.

- Market intelligence

- Risk Policy Implementation

- Quantification and Risk Measurement

- Derivatives Portfolio

Management - Economic and Statistical Analysis of Market Variables

Team

Patrick Funaro

Experience

Over 27 years of experience in the agri-sector in South America, working with risk management, structured finance, derivatives, sales, trading and private equity. Was a partner of FinEx Partners, Executive Director and Head LATAM at Natixis, Head of Commodities at ICAP, founder of Bioenergy Developemnt Fund and head LATAM at FIMAT/Societé Générale.

Patrick is a founder of the Brazilian Sugar Club.

Academic education

Université Paris-Dauphine, Management and Master in New Technologies

Matias Eli

Experience

Over 26 years in risk management, hedging and structured finance. CV includes institutions such as Bankers Trust, LDC and IBP. Was Global Head of OTC Sales at ED&F Man & Latam Head of Commodities at Macquarie.

Academic education

Pontifícia Universidade Católica, São Paulo, Business Administration